Understanding the VIX Term Structure

A Key Indicator for Options Traders

Today, equity markets extended last week’s sell-off, with both the S&P 500 (SPY) and Nasdaq (QQQ) closing below their 200-day moving averages and officially entering correction territory. As tech stocks plunged from recent highs, tariff concerns mounted, and economic uncertainty grew, options traders turned to a crucial market gauge—the VIX Term Structure—to assess their risk exposure.

The VIX Term Structure is a powerful yet often misunderstood tool for options traders. While it may seem complex at first, breaking it down into key components makes it much more approachable.

In this article, I’ll simplify the concept and explain how you can use it to refine your trading strategy.

The VIX Term Structure is the term used by the Chicago Board Options Exchange (CBOE) to describe the expected volatility of the S&P 500 Index over various timeframes, derived from S&P 500 options with different expiration dates.

The VIX Index, often referred to as the "fear gauge," represents the market’s expectations for price fluctuations in the S&P 500 over the next 30 days. It is a single number that reflects near-term volatility expectations.

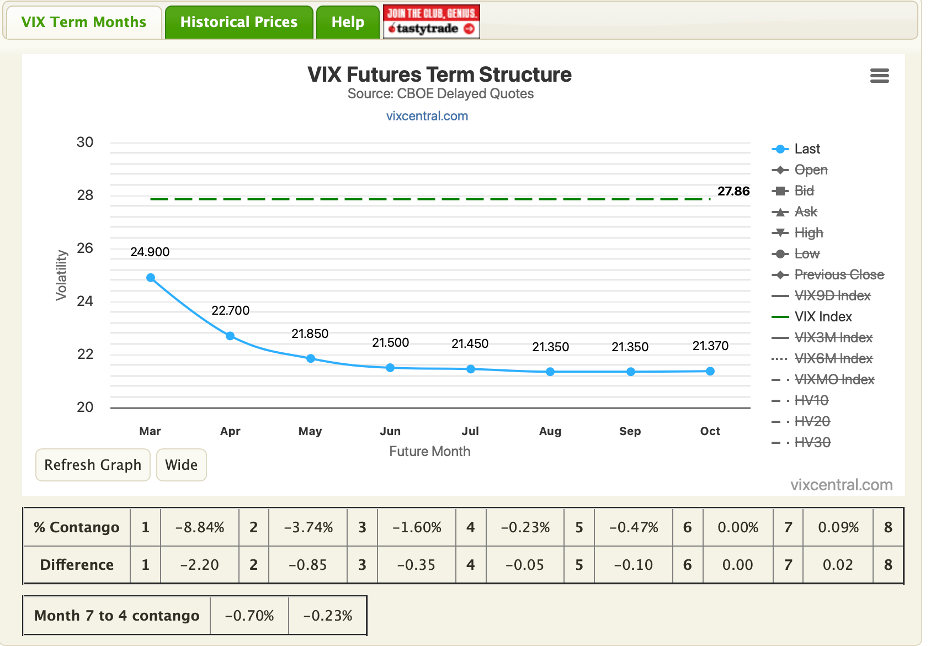

In contrast, the VIX Term Structure is a series of values measuring expected volatility across multiple option expiration dates. This allows traders to assess how market expectations for volatility change over time, helping them make informed decisions about risk and positioning. A great source for looking at the current and past VIX Term Structure is www.vixcentral.com

When markets experience sharp selloffs like we experienced this past couple of weeks, it’s essential to monitor the VIX Term Structure daily to gauge the market’s expectations for future volatility. Before diving into the VIX Term Structure, it's crucial to understand Contango and Backwardation, two key concepts from the futures market.

Contango occurs when futures prices are higher than the current spot price, primarily due to the cost of carry—expenses like storage or financing. For example, if oil costs $50 per barrel today, but storing it for three months costs $1 per barrel, a buyer might prefer to pay $51 for future delivery instead of holding it now.

Backwardation is the opposite—when the spot price exceeds future prices. This often happens in commodity markets during supply shortages, where immediate delivery is valued more to keep operations running.

These principles also apply to financial futures, including VIX Futures. Instead of storage costs, financial instruments have an interest-related cost of carry. Under normal conditions, VIX Futures are typically in Contango. However, during market panics, the spot VIX spikes, while futures prices may rise less, reflecting the expectation that volatility will subside.

TheVIX Term Structure Chart below reveals the market’s current state as of Monday, March 10th, 2025.

When in Contango, markets are calm and functioning normally. When it shifts to Backwardation, like we are seeing now, it indicates some panic has set in—hence my saying, "Bad things happen in Backwardation."

While some panics, like Brexit, resolve quickly, others, like the 2008 financial crisis, can keep markets in Backwardation for extended periods. While contrarian trades can be profitable, history shows that major declines often follow a shift into Backwardation. In such conditions, it’s wise to limit bullish trades and closely monitor the VIX Term Structure, waiting for a move back to Contango as a signal that the panic is likely over.

Thanks Gavin, I can’t believe for all these years I never knew about the importance of the VIX until I started studying options and then attended your October Masterclass in Options which you covered in detail. It’s now an integral part of my daily process, thanks.