MARKET PERFORMANCE

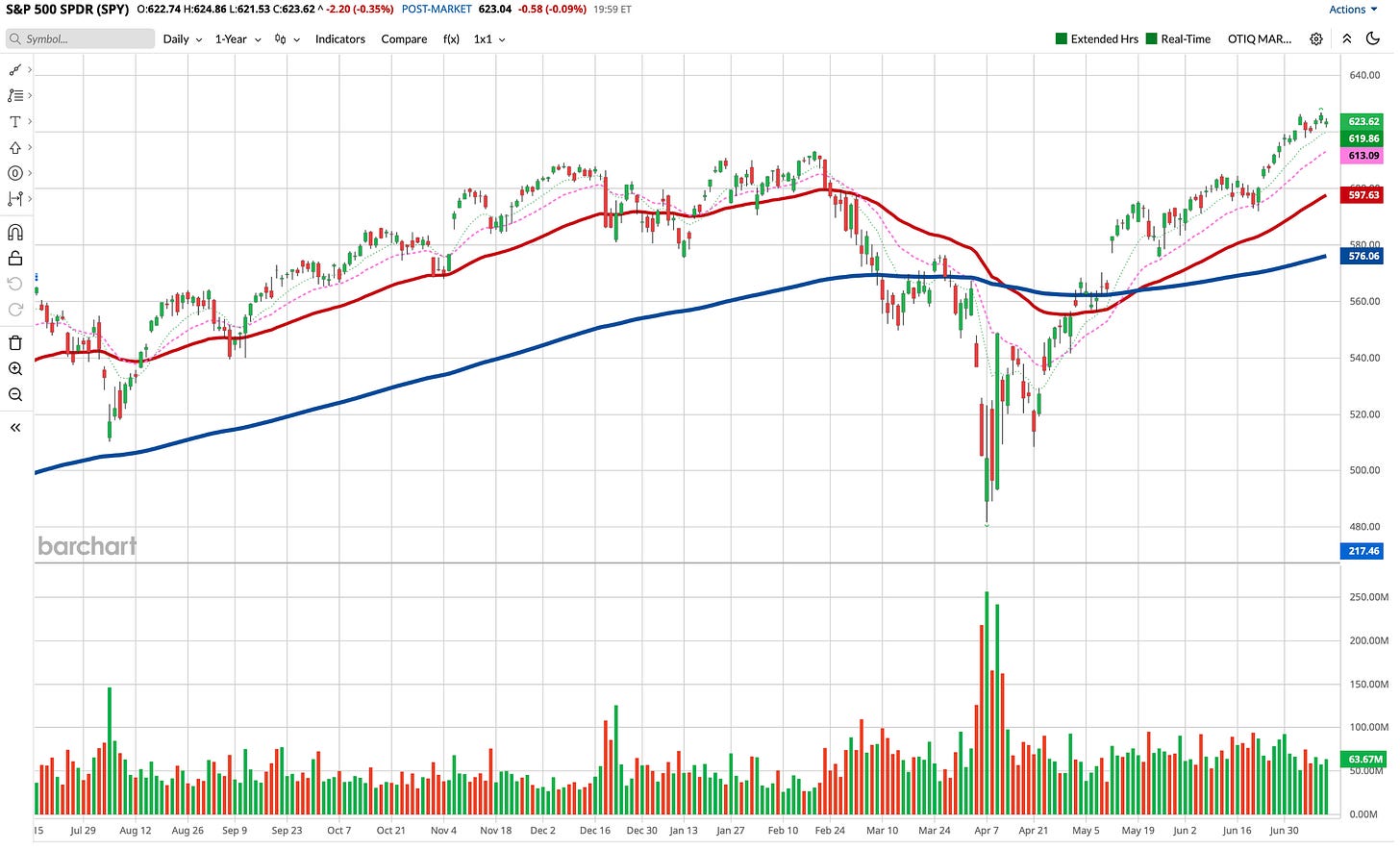

Markets saw a modest pullback last week, trading mostly sideways amid rising macroeconomic uncertainty. The S&P 500 (SPY) slipped -0.28%, while the Nasdaq (QQQ) edged down -0.36%. Small-cap stocks underperformed, with the Russell 2000 (IWM) falling -0.62% as investors weighted growing geopolitical risk and tariff concerns.

Delta Air Lines (DAL) jumped over 12% on strong earnings. Moderna (MRNA) rose after its COVID-19 vaccine was approved for children aged 6 months to 11 years at higher risk. Tapestry (TPR) gained on better guidance, and Boeing (BA) advanced as an Indian crash investigation found no mechanical fault.

President Trump implemented a 35% tariff on Canadian imports, effective August 1, while exempting goods that comply with USMCA standards. He has also indicated the possibility of additional tariffs for other trade partners and has proposed a 50% tariff on copper. Although these actions may contribute to higher inflation, it remains premature to project their long-term effects, as the Federal Reserve continues to evaluate policy options. The Fed presently expects to implement two interest rate cuts in 2025, though this timeline could be extended should economic conditions remain robust.

SECTOR PERFORMANCE

This week observed a strategic shift from growth-oriented sectors towards defensive and commodity-linked segments. The Energy sector (XLE) advanced by 2.41%, supported by escalating oil prices and ongoing supply chain concerns following recent tariff announcements. Utilities (XLU) posted a 0.75% increase, indicative of a more defensive positioning amid heightened geopolitical risks. Industrials (XLI) and Materials (XLB) registered moderate gains, while performance in other sectors was generally flat or negative.

The Financials (XLF) sector declined by 1.94%, Communications (XLC) fell by 1.88%, and Consumer Staples (XLP) decreased by 1.67%, as all three sectors experienced risk-off sentiment. This was attributed to traders reevaluating their positions in anticipation of the upcoming earnings season and heightened macroeconomic headline risks.

MARKET BREADTH & VOLATILTY

Market breadth is still positive on intermediate timeframes, with 67% of stocks above their 50-day average. Although there’s been a small pullback since last week, the short-term outlook remains bullish. Selectivity is advised, as XLF and XLC show weakness suggesting hedging or reduced positions, while XLE, XLI, and XLU support trend continuation setups.

Volatility is subdued, with the VIX in the mid-16s, which is favorable for directional trades and premium selling. Despite tariffs and macro concerns, implied volatility is stable, and the VIX futures remain in contango, indicating expectations of continued low volatility.

Pre-Market Report

Stock Market This Week: Five Themes To Watch

Markets enter the heart of earnings season with the S&P 500 facing a critical test as major financial institutions kick off quarterly results amid escalating trade tensions. President Trump's Saturday announcement of 30% tariffs on the European Union and Mexico, with overall tariffs set to surpass April 2 Liberation Day levels, has injected fresh uncertainty into markets already grappling with inflation concerns and Fed policy implications. The President's suggestion that he might raise the 10% baseline tariff to 15%-20% adds another layer of complexity for investors parsing corporate earnings guidance and economic data. This week delivers a comprehensive assessment of economic health through Tuesday's CPI report, Wednesday's PPI data, and Thursday's retail sales figures, all while heavyweight earnings from JPMorgan, Wells Fargo, and other major banks set the tone for the broader earnings cycle.

Here are 5 things to watch this week in the Market.

Banking Sector Earnings Bonanza

The financial sector takes center stage with a parade of major bank earnings beginning Tuesday with JPMorgan, Wells Fargo, and Citigroup, followed Wednesday by Bank of America, Morgan Stanley, and Goldman Sachs. These reports will provide crucial insights into credit conditions, loan demand, and the health of consumer and commercial banking amid the evolving economic landscape. Net interest margins will be closely watched as banks navigate the current interest rate environment, while credit loss provisions could signal management's outlook on economic conditions. Investment banking revenues at Goldman and Morgan Stanley will offer perspective on capital markets activity and corporate deal flow. The banks' commentary on commercial real estate exposure, consumer credit trends, and the impact of recent regulatory changes will be particularly important for assessing sector health. Given the new tariff announcements, management guidance on potential impacts from trade policy changes could significantly influence not only bank stocks but broader market sentiment about economic growth prospects.

Inflation Reality Check

Tuesday's Consumer Price Index report at 8:30am represents the week's most significant economic release, providing the Federal Reserve's key inflation gauge amid ongoing price pressure concerns. Both headline and core CPI readings will be scrutinized for evidence of progress toward the Fed's 2% target, particularly important given recent mixed signals on inflation trends. Wednesday's Producer Price Index at 8:30am will offer additional perspective on wholesale price pressures and potential future consumer inflation. The timing of these reports alongside major earnings creates potential for amplified market reactions if inflation data contradicts or supports corporate commentary about cost pressures and pricing power. Energy prices, housing costs, and services inflation will be key components to watch, especially given the potential impact of new tariffs on imported goods pricing. Any significant deviation from expectations could influence Fed policy expectations and create substantial volatility in rate-sensitive sectors including technology, utilities, and real estate.

Consumer Spending Spotlight

Thursday's retail sales data at 8:30am will provide an important read on consumer spending patterns, arriving alongside core retail sales figures that exclude volatile automotive purchases. This data comes at a critical juncture as markets assess consumer resilience amid ongoing economic uncertainties and potential tariff impacts on goods pricing. The retail sales figures will be particularly important for interpreting earnings results from consumer-facing companies and assessing the sustainability of consumer-driven economic growth. Initial jobless claims data Thursday will complement the spending picture by providing the latest snapshot of labor market conditions. The Philadelphia Fed Manufacturing Index will offer additional perspective on regional economic activity and business conditions. The convergence of consumer spending, employment, and manufacturing data creates potential for significant market moves if indicators collectively suggest strengthening or weakening economic momentum.

Tech and Global Earnings Convergence

The week features a diverse array of earnings beyond financials, with Taiwan Semiconductor Thursday providing crucial insights into global chip demand and AI infrastructure buildout. Netflix Thursday will offer perspective on streaming growth and content spending amid intensifying competition. Industrial bellwether General Electric Thursday will provide insights into manufacturing and infrastructure demand. Healthcare earnings from Johnson & Johnson Wednesday and Abbott Laboratories Thursday will offer perspective on medical device and pharmaceutical trends. Netherlands-based ASML Wednesday will provide notable insights into semiconductor equipment demand, particularly important given the AI chip cycle and geopolitical considerations affecting the industry.

Tariff Turbulence and Trade Policy Impact

Trump's announcement of 30% tariffs on the EU and Mexico, along with potential increases to the baseline 10% tariff up to 15%-20%, creates a complex backdrop for earnings interpretations and economic data analysis. Companies with significant European or Mexican operations, import dependencies, or supply chain exposure to these regions could face renewed scrutiny during earnings calls. The tariff escalation beyond April 2 Liberation Day levels suggests an intensification of trade policy that could impact everything from consumer goods pricing to industrial supply chains. Sectors particularly vulnerable include retail, automotive, technology hardware, and consumer staples companies reliant on imported goods or international manufacturing. Management commentary about tariff mitigation strategies, supply chain diversification, and pricing power will be vital for assessing corporate resilience. The combination of tariff announcements with key economic data and earnings results creates potential for heightened volatility as investors reassess growth prospects and inflation implications.

Trader Mindset Going Into the Week

Markets enter mid-July in a holding pattern with sideways price action, modest sector rotation, and relatively low volatility. While the broader trend remains constructive, short-term breadth deterioration and rising macro uncertainty are introducing a more selective and tactical environment for traders.

The tariff announcement from President Trump, and the potential for broader trade retaliation, has injected a degree of caution into the market. Still, volatility remains subdued, with the VIX hovering around 16 and VIX future curve in healthy contango. This implies the market isn’t pricing in imminent disruption, but traders should be in tune this week with upcoming CPI print and start of the earnings season.

Sector rotation continues beneath the surface, as leadership has shifted away from tech and communications toward energy, utilities and industrials.

OTIQ Premium – Access the Weekly Trade Grid.

The Premium Weekly Trade Grid provides exclusive stock and ETF picks for paid subscribers, based on analysis of macro trends, sector rotation, technical signals, and volatility setups.

Each trade idea comes from our market review framework, factoring in trend strength, catalysts, and earnings season. We aim to provide actionable trade themes beyond simple alerts, including pre-earnings setups, momentum strategies, and event-driven trades.

To receive the OTIQ Premium weekly Grid, consider becoming a paid subscriber.

OTIQ Premium Trade Grid as of July 6th, 2025

Keep reading with a 7-day free trial

Subscribe to Options Trading IQ Substack to keep reading this post and get 7 days of free access to the full post archives.