📈 Day 3: Vertical Call Spread (VCS)

A leveraged way to play bullish momentum with defined, limited risk.

📘 Quick Refresher

So far, we’ve covered:

Day 1: CSP → premium income, heavy capital, willingness to own SPY.

Day 2: VPS → defined-risk version, smaller capital, capped gains.

Today we flip to the call side with a vertical call spread (VCS). Unlike puts, this structure is directional and requires SPY to club higher to avoid losses. It’s simple, defined-risk way to bet bullish.

Day 3: Vertical Call Spread (VCS)

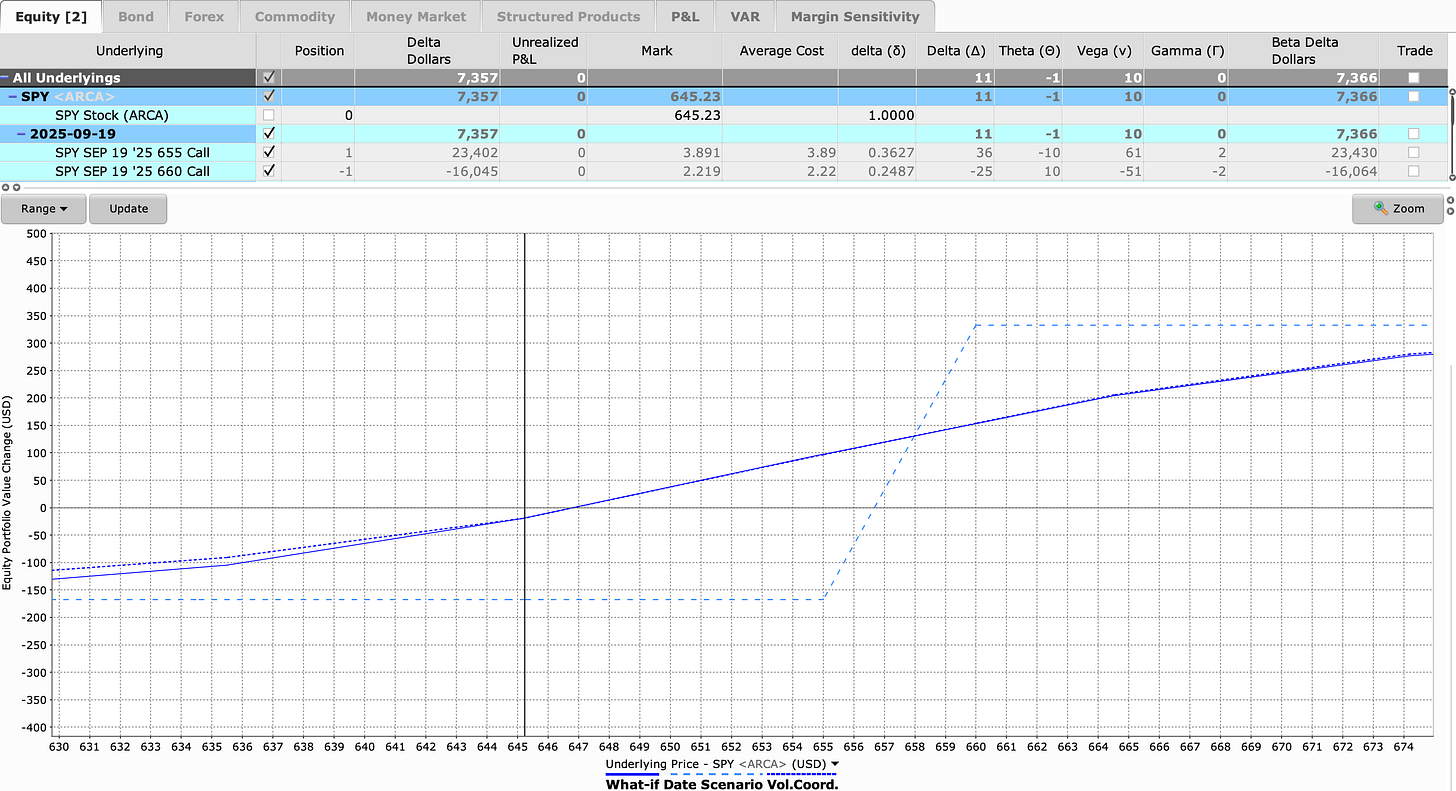

🔹 Trade:

Buy SPY 655 Call (exp. 19-Sep-2025) @ 3.89

Sell SPY 660 Call (exp. 19-Sep-2025) @ 2.22

Net Debit: 1.67

Payoff Profile

Max Profit: $333 (if SPY ≥ 660 at expiration).

Max Loss: $167 (debit paid).

Break-even: 656.67.

Risk/Reward Ratio: ~1:2.

Objective: The goal of this trade is to capture leveraged upside in SPY with minimal capital at risk. Unlike the CSP and VPS, which generate income by selling premium, the VCS flips the script: you’re paying a small debit for the chance to profit from a sharp, directional move. This structure fits traders who want bullish exposure without tying up tens of thousands in cash or taking undefined downside risk.

Trading Style: Vertical call spreads work best in environments where momentum favors the upside; think breakouts from consolidation, strong sector rotation into risk assets, or bullish seasonality. They are particularly attractive in underlying stocks and ETFs where options are liquid and spreads are tight. The VCS setup here focuses on buying out-of-the-money calls (around 30 delta) and pairing them with a short call 5–10 points higher. This creates a defined-risk spread that costs far less than a long call while still providing meaningful upside if the move materializes. Duration is typically short, two to three weeks, to align with bursts of momentum. Because short-term trades carry higher gamma, position sizing is crucial: keep risk per trade aligned with your loss tolerance (often 1-2% of account value).

Entry Guidelines: Look for breakout setups or momentum confirmation (e.g., RSI > 55, or price clearing recent resistance). Enter with 10–21 days to expiration, where gamma is elevated but time decay has not yet become overwhelming. Buy the long call OTM, sell the short call 5-10 points higher. Favor entry on consolidation or slight pullbacks, which lower the cost of the debit spread. Size trades based on maximum loss tolerance. Since debit spreads can easily expire worthless, only risk what you’re comfortable losing.

Exit Guidelines: When profit reaches 50-75% of maximum potential gain. If SPY runs quickly in your direction, take profits rather than hold for perfection. Full debit paid represents max risk, but practically many traders cut losses early if spreads love 50% of value. If momentum stalls and the spread remains near breakeven after a week, consider redeploying capital elsewhere.

Why It Works: The VCS turns a pure long call into a more efficient structure. By selling a higher strike against the long call, you lower the entry cost and reduce the impact of volatility decay, while still maintaining strong leverage to the upside. It’s a way to “rent” bullish exposure for a fraction of the cost of owning shares or even long calls, making it especially appealing for short-term tactical traders.

Risk Considerations: The primary risk is straightforward: if SPY drifts sideways or declines, the debit paid erodes quickly. Because the trade is short-term and out-of-the-money, it’s easy to hit max loss if the move doesn’t arrive fast enough. Gamma risk is also elevated and can move quickly against you. Additionally, the position delta can flip rapidly. Assignment risk is minimal since both legs are calls and out-of-the-money at entry, but expiration risk exists if SPY closes near the short strike.

Putting it Together: The Vertical Call Spread represents the aggressive end of our bullish toolkit so far. Compared to the CSP and VPS, it requires far less capital but demands sharper timing. You’re trading efficiency for speed with tight risk, capped reward, and high sensitivity to direction. This structure is best used when you believe a breakout or catalyst will send prices higher in the near term.

Comparing VCS to Other Bullish Trades

Relative to CSP and VPS, the VCS represents a more offensive posture:

✅ Strengths: Cheap to enter, limited risk, leveraged upside potential.

❌ Weaknesses: Highly sensitive to timing, can easily expire worthless.

📝 End-of-Day Recap

The Vertical Call Spread highlights how traders can flip from premium-seller to premium-buyer while still maintaining defined risk. It’s capital-light, sharp in its payoff, and ideal for short bursts of bullish conviction. The trade-off is timing where if you get it right, you enjoy quick gains; get it wrong, and the debit evaporates fast.

With CSPs and VPS, we saw how traders get paid to wait. With the VCS, you’re paying for speed. Tomorrow, in Day 4: Calendar Spread, we’ll examine how time itself becomes the key profit driver and balancing short-term decay against long-term optionality.