📈 Day 2: Vertical Put Spread (VPS)

A capital-efficient way to take the same bullish view with defined risk.

📘 Quick Refresher

Yesterday, we kicked off this series with the Cash-Secured Put (CSP), a conservative way to collect income while being willing to own SPY at a discount, and converting into a Wheel Trade Strategy. The CSP works, but it ties up a large amount of capital. Today, we’ll take that same idea of “getting paid if SPY stays above a certain level” and repackage it into something far more capital efficient: the Vertical Put Spread (VPS).

Day 2: Vertical Put Spread (VPS)

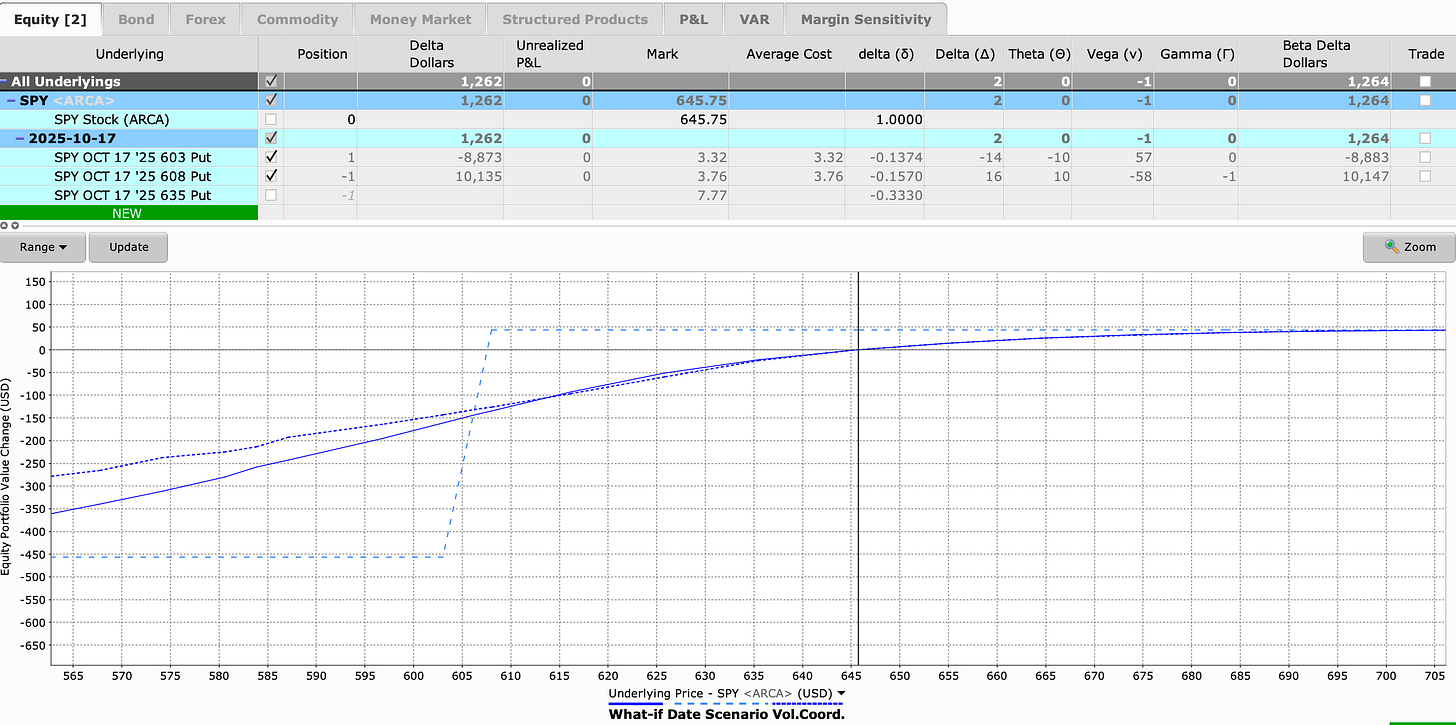

🔹 Setup: Sell 608 Put / Buy 603 Put expiring 17-October-2025.

Premium Collected: $0.44

Capital Requirement: $500.

Break-even: $607.25

This trade expresses a bullish-to-neutral thesis: SPY just needs to remain above 608 at expiration. The short put collects premium, while the long put caps downside exposure, limiting the worst-case scenario to $500 per contract less the premium received.

Objective: The VPS strategy builds on the CSP approach, but defines risk and increases capital efficiency. The goal is to target annualized returns in the 15-25% range, generate consistent monthly income, and keep drawdowns under control by not risking more than 5% of total capital per trade.

Trading Style: This approach focuses on selling monthly bull put spreads with 30 to 45 days until expiration, giving enough time for theta decay to work while keeping risk contained. The short strike is typically placed just below key technical support levels, where buyers have historically stepped in. For certain underlyings, particularly stable ETFs or high-quality stocks, durations can be extended out to 60–90 days to capture higher premiums, provided the trader is comfortable with the additional exposure.

Strike selection is guided by probability as much as by chart structure. Short puts are generally sold in the 15–20 delta range, which equates to a roughly 80–85% statistical probability of expiring worthless. Layering this statistical edge beneath visible support zones adds another level of protection, combining probability theory with price action. The result is a strategy that balances consistency with prudence and designed to generate steady premium income while keeping large drawdowns at bay.

Entry Guidelines: Timing matters. Look to open spreads on down days when volatility is higher, since elevated implied volatility inflates premiums. Confirm that the setup produces at least a 10% return on risk if held to expiration. This ensures the trade has enough reward potential to justify the capital at risk.

Exit Guidelines: Profit-taking is disciplined. If you capture 50% of the max profit in less than half the trade’s duration, close early and redeploy capital elsewhere. This locks in gains while avoiding the risk of giving profits back. On the downside, set a stop loss at 2x the credit received. This keeps losses manageable and prevents small setbacks from turning into portfolio-damaging events.

Why It Works: The Vertical Put Spread takes the bullish spirit of the Cash-Secured Put but packages it far more efficiently. Instead of tying up $62,000 in cash to secure 100 shares, the VPS requires only $500 per contract at risk, and that’s the worst-case scenario. In exchange, you still collect premium up front, with a broad profit zone as long as SPY remains above the short strike at expiration. This combination of efficiency, defined risk, and high probability makes the VPS especially appealing to smaller accounts or those looking to scale across multiple underlyings.

Risk Considerations: Like any bullish trade, the primary risk is that the underlying falls below the short strike, leading to losses. Early assignment is possible, though uncommon, and typically arises when the short option drifts in-the-money close to expiration. A more pressing concern is expiration risk., if SPY hovers just above or just below the short strike, assignment could occur and the stock may move against you before you can cover. The simplest way to mitigate this is to close the spread before expiration rather than pushing your luck into the final hours.

Putting It Together: The VPS demonstrates how small adjustments in structure can transform both the capital footprint and risk profile. Compared to the CSP, it delivers accessibility, tighter risk control, and the flexibility to diversify across trades without overcommitting capital. By focusing on probability-based entries, disciplined exits, and risk-defined sizing, traders can generate steady premium income while keeping portfolio drawdowns in check.

Comparing VPS to Other Bullish Trades

The VPS is essentially the “efficient cousin” of the CSP:

✅ Strengths: Low capital requirement, defined risk, accessible for smaller accounts.

❌ Weaknesses: Capped gains.

📝 End of Day Recap

The Vertical Put Spread takes the CSP’s logic and trims away the fat. It asks far less capital and limits downside to a fixed dollar amount, which makes it accessible for traders with smaller accounts or those who don’t want to risk full assignment. You sacrifice some income potential, but in return you gain a cleaner risk profile.

Viewed in sequence, the CSP and VPS are two sides of the same coin: one caters to capital-heavy investors comfortable owning stock, while the other appeals to traders who prioritize efficiency and risk control. Together, they show how even small adjustments in structure can dramatically change the capital footprint and payoff shape.

Tomorrow, in Day 3: Vertical Call Spread (VCS), we’ll flip from premium-selling to premium-buying and look at a bullish trade that risks a small debit for the chance to capture leveraged upside.